Crude oil has been above $100/barrel for a longer period of time, and high oil prices have caused many products in the chemical industry chain to be overwhelmed. High cost pressure will be transmitted downward through the industry chain model, but the closer to the terminal products, the weaker the cost downward effect may be. This is because the end-consumer market is more sensitive to the price, but also related to the special nature of the country’s livelihood. Translated with www.DeepL.com/Translator (free version)

In previous rounds of high crude oil price volatility, such as late 2020 and mid-2021, the end market reacted with production cuts. Many intermediate products in the chemical industry chain, after a brief price increase, quickly returned to the previous price levels and silently endured the erosion of profits from rising raw materials.

This long cycle of crude oil prices hovering at a high level has led to a value shift in the chemical industry chain, mainly in the form of: high crude oil dominance, zero profit production of intermediate products in the industry chain, the end-consumer market hard through the winter. We 2022 January-June major commodity prices up and down to do a comb, can initially see its end.

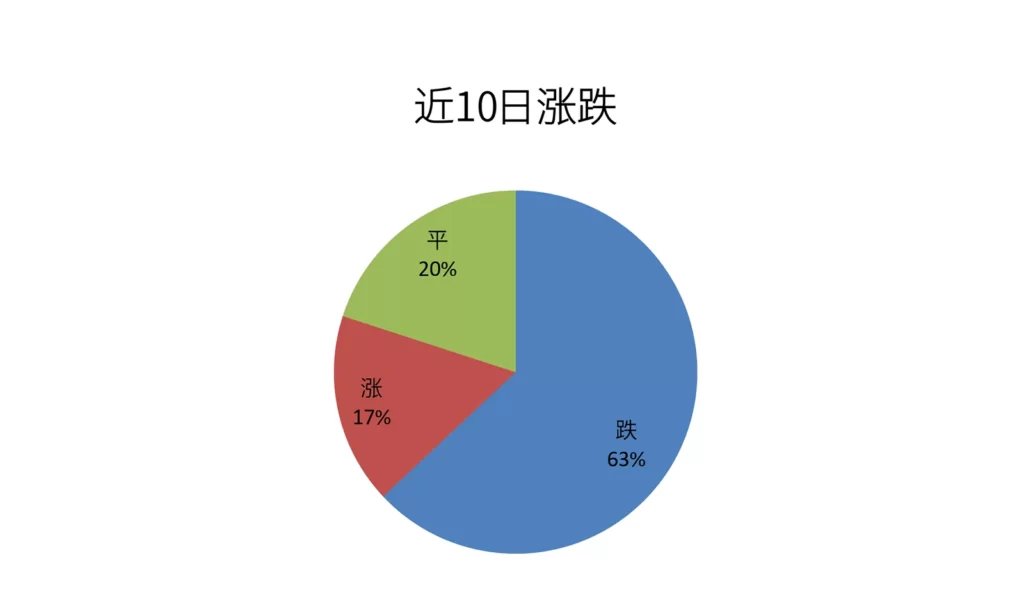

From the nearly 450 bulk chemical prices up and down, in the past 10 days, the cumulative rise in the product only 75, during the price of a stable product 91, and a decline in the product 284, the number of falling products accounted for 63%.

The products with the largest declines were liquid chlorine, isobutyraldehyde, neopentyl glycol, palm oil, epichlorohydrin, octanol, ethylene glycol butyl ether, DINP, DOTP, propylene glycol, chloroacetic acid, sulfur, n-butanol, and bisphenol A.

Liquid chlorine is the product that has fallen the most in the past 10 days, with a cumulative drop of 115%. Currently, the price of liquid chlorine in Shandong and Jiangsu areas has appeared to be around -400 yuan per ton. Roughly speaking, if you drive to load liquid chlorine, manufacturers will have to pay you 400 yuan per ton. The plunge in liquid chlorine prices reflects the balance of China’s chlor-alkali installations. Translated with www.DeepL.com/Translator (free version)

Isobutyraldehyde prices fell 37% in the past 10 days, ranking second in terms of declines. The plunge in isobutyraldehyde prices was mainly driven by the plunge in raw material propylene prices, and the downstream neopentyl glycol market prices also continued to plunge.

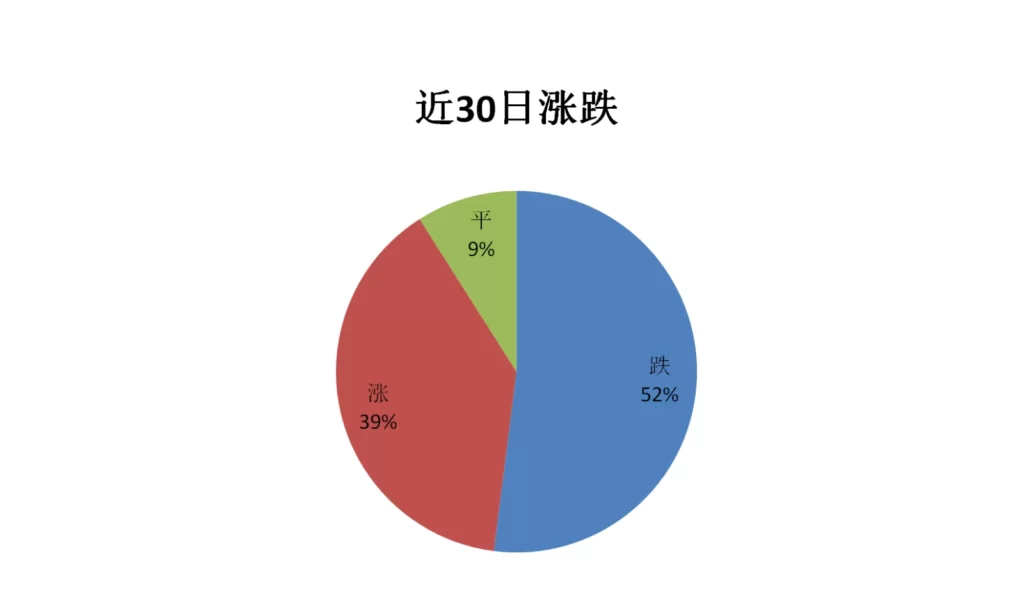

If the past 10 days reflect short-term market volatility, zoom out to 30 days to look at price volatility in the Chinese bulk chemical market.

Of the 450 bulk chemicals counted, the number of products that have seen a decline in the past 30 days is 235, or 52 percent. Nine percent of the bulk chemicals were relatively flat, and only 39 percent of the bulk chemicals showed a slow rise.

The product with the biggest drop is still liquid chlorine, which is in first place with a cumulative drop of 59% in 30 days. This was followed by trichloromethane, lithium hexafluorophosphate, fatty alcohol, methylene chloride, ethylene, isobutyraldehyde, butanone, vinyl chloride, nonionic surfactants, acetonitrile, anionic surfactants, polytetrabenzoic acid dianhydride, spandex, and bisphenol A. Translated with www.DeepL.com/Translator (free version)

In the past 30 days, China’s bulk chemicals have not only fallen more than they rose, but also appeared to fall deeper and rise shorter, showing a sluggish atmosphere in the bulk chemicals industry as a whole.

Let’s lengthen the study period and look at the price volatility of the Chinese bulk chemical market over the past 6 months.

From the 540 bulk chemicals counted, within January-June 2022, there were 190 products with cumulative increases, 19 products with stable fluctuations, and 240 products with decreases in China’s bulk chemicals, accounting for 54% of the total.

In the past six months, liquid chlorine is still the product with the largest decline, with a cumulative drop of 108%, from a peak of RMB 1,500/ton in the previous period to the current RMB -400/ton, leading the list of declines. In addition, lithium hexafluorophosphate has also fallen significantly in the past six months, with a cumulative decline of 44%, a huge drop.

Chemicals that have fallen significantly include: isobutyraldehyde, trichloromethane, neopentyl glycol, methylene chloride, ethylene glycol butyl ether, dodecyl alcohol ester, epichlorohydrin, octanol, bisphenol A, etc. Most of these falling chemicals are products in the middle of the chemical industry chain, but also the more prominent contradiction between supply and demand in the market. Such products, in resistance to industry chain cost transmission and downstream consumer market pricing discourse, are relatively weak performance.

The continued plunge of intermediate chemicals is in stark contrast to the current sustained high crude oil prices and the weakness of the end-consumer market, making the performance of the chemical industry chain extremely unhealthy. With the passage of time, this unhealthy performance of the chemical industry chain may be accumulating a new crisis

*Disclaimer: The content contained in this article comes from the Internet, WeChat public numbers and other public channels, and we maintain a neutral attitude toward the views expressed in the article. This article is for reference and exchange only. The copyright of the reproduced manuscript belongs to the original author and the institution, and if there is any infringementPlease contact Jetson Chemical for deletion