Recently the industry has been paying more attention to the styrene industry chain, on the one hand, the upcoming peak of styrene production, on the other hand, the cost impact of styrene from the dual role of ethylene and pure benzene, frequent upstream fluctuations, the industry is more concerned about the changes in the cost of styrene, and the future of the styrene industry chain in the Chinese chemical industry, the shift in the competitive landscape. Translated with www.DeepL.com/Translator (free version)

The main raw materials of styrene are pure benzene and ethylene, of which the downstream products of styrene are PS, ABS, EPS, SBR, UPR, etc. Most of the downstream products are mainly polymer materials, and some of the downstream of styrene are involved in the production of fine chemicals.

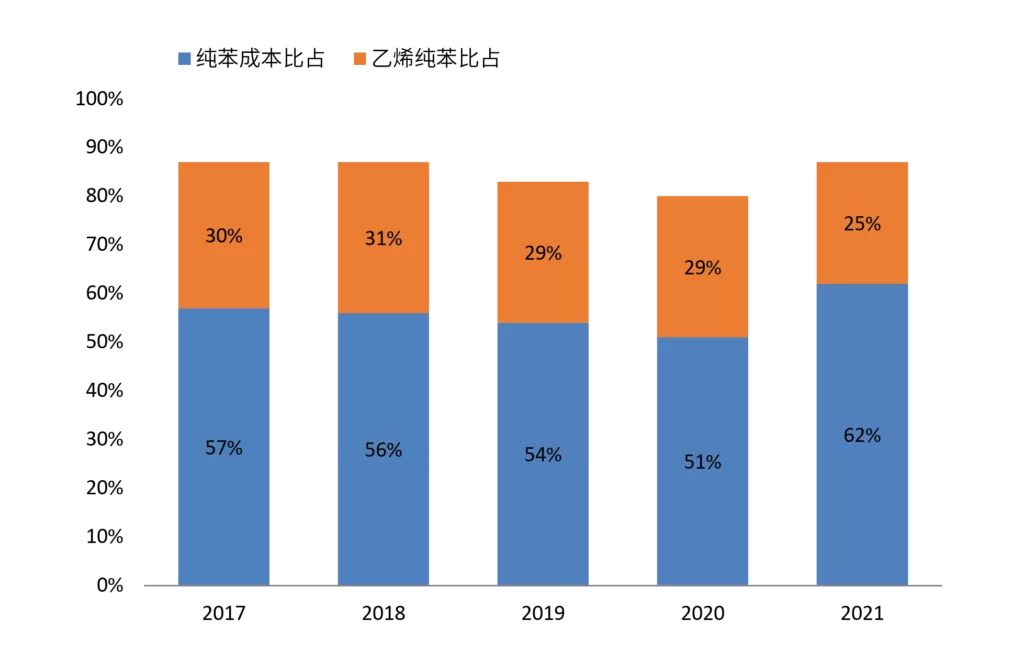

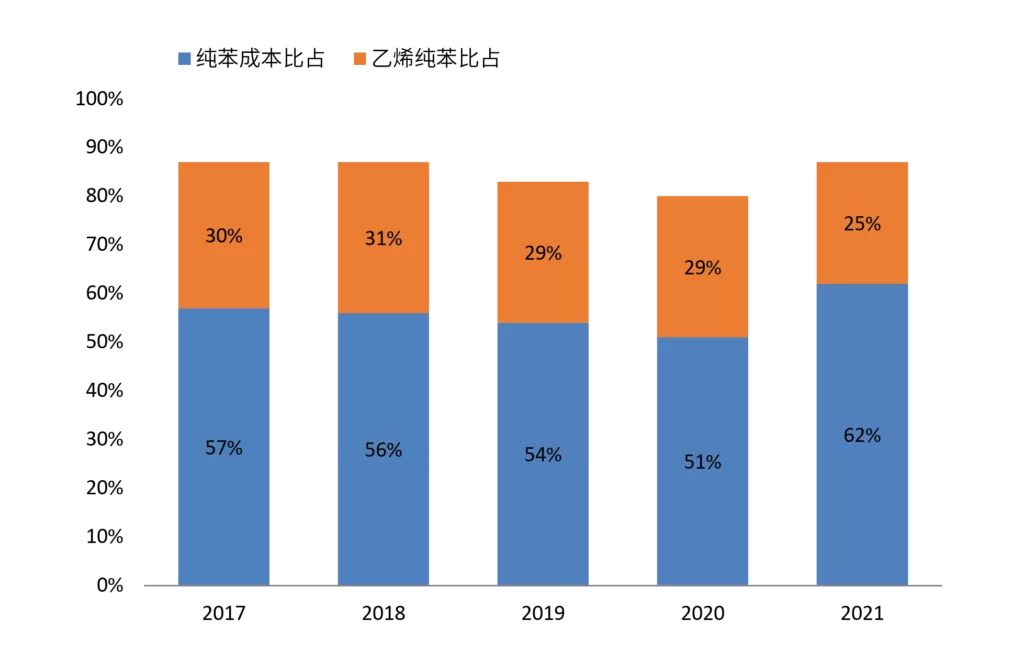

The variable cost of styrene feedstock is composed of 0.79 pure benzene and 0.29 ethylene, with pure benzene accounting for the largest cost share. According to 2021 data, the annual market price of pure benzene in China in 2021 is at RMB 7121/ton, and the annual market price of ethylene is at RMB 7887/ton. In 2021, pure benzene accounts for 62% of the raw material variable cost of styrene in China, and ethylene accounts for about 25%. It can be seen that the price fluctuation of pure benzene has the largest cost share for styrene.

For the history of styrene raw materials can be turned into this look, I collected the past five years of China’s market prices of ethylene and pure benzene, measured according to the cost of styrene, to get the following conclusions.

For one, pure benzene has been the largest variable share of styrene feedstock costs over the past five years, with pure benzene in the 51%-62% range of styrene feedstock costs, while ethylene has consistently accounted for 25%-30% of styrene feedstock variable costs in the range.

Second, the share of pure benzene in the variable cost of feedstock for styrene is growing year by year, from about 57% initially to about 61% in 2021, while the share of ethylene in the cost is slowly falling, from 30% in 2017 to about 25% in 2021. This also indicates that the value of pure benzene in China is increasing faster than ethylene, which is growing at a slightly slower rate.

Third, styrene basic supporting ethylene or ethylbenzene plant, while most of the purchased pure benzene is the main. If the company is self-supplied ethylene and purchased pure benzene, pure benzene for styrene feedstock costs account for a larger proportion. And if ethylene and pure benzene are purchased or all self-supplied enterprises, pure benzene is still the largest raw material cost of styrene.

Pure benzene has become the largest cost share of raw materials for styrene, which will also lead to a greater impact of pure benzene price fluctuations on the cost of styrene. However, based on the verification of several thousand historical data points, it can be seen that the correlation of ethylene price fluctuations on styrene is higher than that of pure benzene, where the correlation between ethylene and styrene is around 94%, while the correlation between pure benzene and styrene is only around 81%.

Although both correlations for styrene are strong, ethylene has a more direct and rapid impact on the price of styrene, and price fluctuations in ethylene have a more direct impact on the price of styrene. The impact of pure benzene on the price of styrene is weaker than that of ethylene. In other words, if the price of ethylene and pure benzene fluctuates at the same rate, ethylene has a greater impact on styrene.

This phenomenon is attributed to the value-influencing logic of styrene.

One, ethylene and styrene industry chain supporting relationship is stronger, the volatility of ethylene more from their own integrated projects of crude oil fluctuations, so in integrated projects, ethylene for styrene prices more direct impact.

Second, the correlation between ethylene and crude oil is stronger, and ethylene prices are set more with reference to foreign naphtha prices, which have a correlation of more than 98% with crude oil. So from the raw material side of the fluctuations, ethylene fluctuations are closer to crude oil, thus indirectly reflecting the impact of styrene. The correlation between pure benzene and crude oil is less than 80%, and the source of pure benzene is refinery reforming and ethylene aromatics extraction, which leads to a weaker impact of pure benzene on the price fluctuation of raw materials.

Third, pure benzene has the largest cost share for styrene, but price fluctuations have a weaker impact on styrene than ethylene, which will lead to the economics of styrene producers, or will create the illusion of weak price sensitivity of pure benzene, which indirectly affects the pricing strategy of styrene companies.

Pure benzene will continue to be the largest raw material cost for styrene in the future, with the estimated impact of pure benzene on styrene’s raw material cost ratio at 57% and ethylene on styrene’s cost ratio at about 27%. With the scale of ethylene supply, the sensitivity of ethylene prices to styrene prices may change with the change in supply and demand structure, and the influence of pure benzene price fluctuations on styrene is expected to gradually strengthen.

*Disclaimer: The content contained in this article comes from the Internet, WeChat public numbers and other public channels, and we maintain a neutral attitude toward the views expressed in the article. This article is for reference and exchange only. The copyright of the reproduced manuscript belongs to the original author and the institution, and if there is any infringementPlease contact Jetson Chemical for deletion